The Impact of the 39% U.S. Tariff on the Swiss Watch Industry, And The Reactions of A Major CEO, the Swiss Fed and an Analyst

"They wanted and elected Trump. Now let American customers pay!" This is what a watchmaker who prefer to remain anonymous told us…

On August 1st – also known as Switzerland’s National Day – the Trump Administration announced a 39% tariff on Swiss imports, coinciding with Secretary of State Marco Rubio publicly praising Switzerland… A political and economic shockwave has gripped the country for nearly two weeks. Rightfully so, Switzerland is heavily export-oriented, and the U.S. is one of its key markets.

As the August 7th deadline for the new measures approaches, two Swiss ministers – Economy and Finance – rushed to Washington just two days before the deadline, but returned empty-handed. Since then, meetings have been taking place daily. Get ready – the shockwaves will be felt hard. What’s at stake for the watch industry? Here’s the breakdown.

The Trump Administration’s logic is simple: the U.S. trade deficit with Switzerland is $39 billion, so let’s impose a 39% tariff! While it has often targeted the pharmaceutical sector (Novartis, Roche, etc.), citing high drug prices in the U.S., the 39% tariff applies across the board, without exception. As a result, many other industries will be hit – and none more so than Switzerland’s flagship export sector: watchmaking. Machinery and food production are also in the firing line. The timing couldn’t be worse: the U.S. remains the last market still showing growth for Swiss watches, while all other regions have been in steady decline for months.

Even though the American President’s decisions are unpredictable and could change overnight, many believe the tariffs are a temporary pressure tactic. Still, the industry expects a rise in short-time work and a wave of layoffs across the Jura Arc (the Arc Jurassien in French), from Geneva to Neuchâtel.

A Heavy Economic Blow for the Jura Arc

“In Neuchâtel alone, where much of the industrial activity is tied to watchmaking, the tariffs affect over 32,000 full-time equivalent jobs,” said Florence Nater, Neuchâtel’s Minister of Economy. A similar situation is unfolding across the Jura Arc – from Geneva to Schaffhausen – home to the core of Swiss watchmaking.

Affected cantons are already planning for a rise in unemployment and are demanding the extension of short-time work (RHT) schemes. This measure allows companies to temporarily reduce or suspend operations without terminating employment contracts. It’s generally used in times of economic hardship to prevent mass layoffs.

RHT enables businesses to respond to temporary drops in demand by reducing working hours. In turn, unemployment insurance partially compensates employees for lost income. Currently capped at 18 months, the cantons are lobbying the federal government to extend it to 24 months. Notably, many brands, movement manufacturers, and subcontractors in the watch industry have already been using RHT since last year.

Second Half of the Year: Somewhat Protected

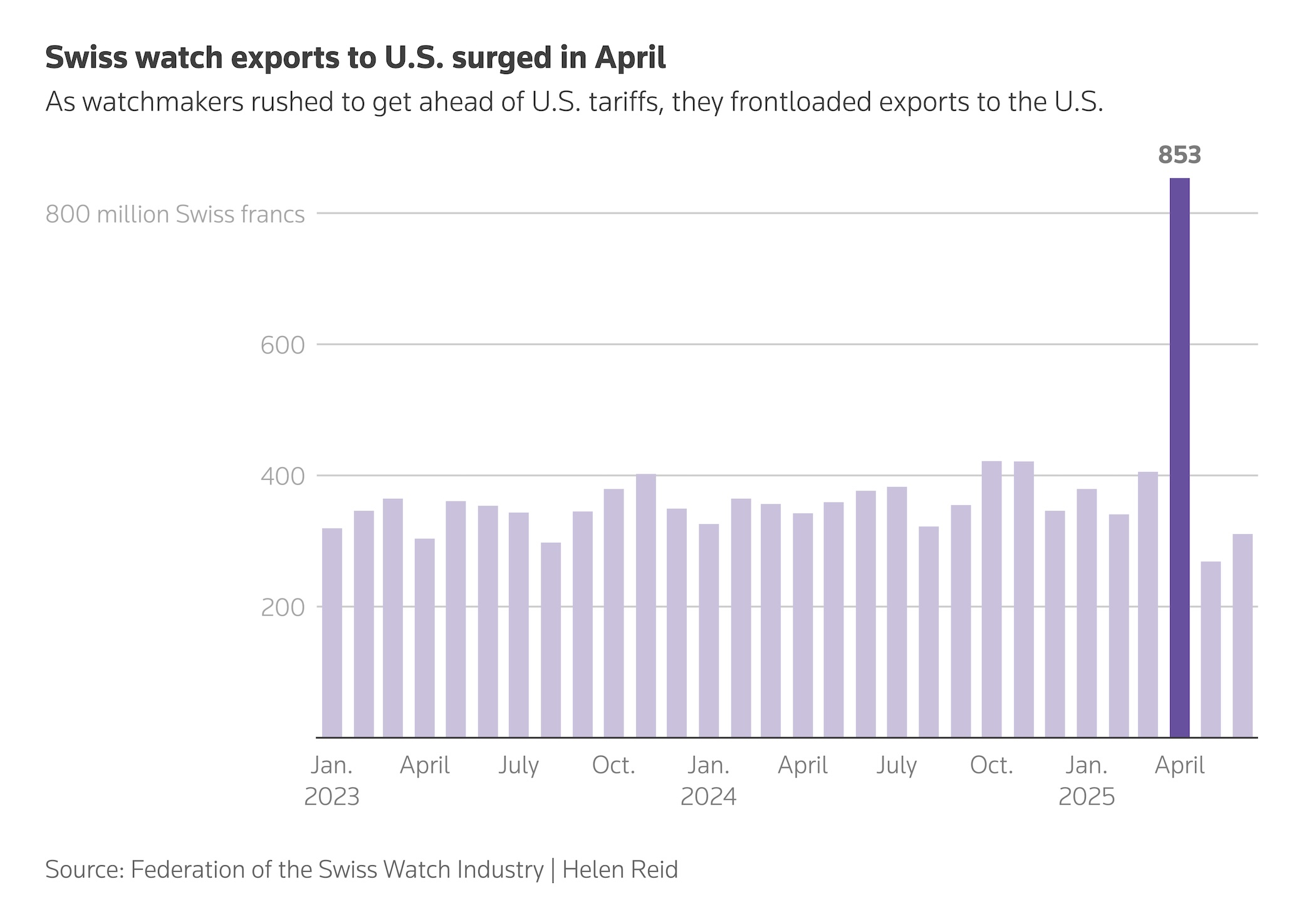

That said, many watchmakers had already taken precautions. Ahead of the August 7 deadline, numerous brands built up their stock in the U.S. to secure their business through the second half of the year – just as they did back in April, when the first 10% surcharge was announced.

As Swatch Group CEO Nick Hayek told Reuters: “We shipped much more product to the United States, so this means there is not an immediate impact on us.” In short, the entire industry took similar action. As a result, most brands should be able to stay afloat through year-end – but the solution is only temporary.

Absorbing cost hikes: no miracle solution

Some are already pointing to high-potential markets like India – citing purchasing power and demographics – now that China seems to have permanently shifted away. But let’s be realistic: this won’t solve the immediate problem. So how can the industry absorb these rising costs? Short answer: there’s no miracle cure

Depending on the price point and brand positioning, the only options are: reduce brand margins, pressure distributors and retailers to cut their margins, and pass the remaining cost to the end customer, a.k.a. the American consumer.

So far, no brand has publicly committed to how they plan to balance this delicate equation. As one watchmaker (who wants to remain anonymous) bluntly put it: “They wanted and elected Trump. Now let American customers pay!”

Relocation? Not an Option for Swiss Watches

While some companies in the industrial and pharmaceutical sectors are considering relocating production to the U.S. or investing heavily there, this is not a viable path for the watch industry. As Nick Hayek explained to Reuters: “We produce everything in Switzerland, not in China. And we have a high cost. And when you add a 39% tariff, we cannot absorb that. So prices will go up for sure.” Swiss-Made regulations require at least 60% of production in Switzerland, making relocation of the production impossible, at least if still using the Swiss-Made norm.

Yves Bugmann, president of the Federation of the Swiss Watch Industry (the FHS), echoed this: “The Swiss-Made label is part of our DNA. The history and expertise of our industry are unique worldwide.” The U.S. is the largest foreign market for Swiss watches, accounting for 16.8% of exports worth CHF 4.4 billion ($5.44 billion). Yves Bugmann added that the tariffs are a “serious blow” that will indirectly hurt the U.S. economy.

An Industry on Edge as Summer Ends

As mid-August holidays end, expect industrial players and brands to mobilise. For now, the industry is in limbo, hoping for a tariff reduction – though only Trump holds the cards. Three key players, the President of the FHS, the Head of Swiss Equity Research at Vontobel and Breitling’s CEO have agreed to participate in a Q&A session.

Yves Bugmann, President of the Federation of the Swiss Watch Industry

Pascal Brand, MONOCHROME – The watchmaking industry is at risk of being heavily impacted. What is your assessment of the potential consequences for the sector (downstream: sales; upstream: supply chain)?

Yves Bugmann – It is still far too early to make forecasts, especially since the Swiss government is striving to limit the damage and Switzerland and the United States are continuing their technical-level negotiations. Many brands took advantage of the short window before the new tariffs came into effect to build up inventory in the U.S., which gives them some leeway to maintain their current pricing strategy. If tariffs remain high in the medium term, price adjustments would likely become inevitable. Compared to other Swiss industries, watchmaking has the advantage that in most segments, it faces little international competition capable of gaining a competitive edge through lower tariffs. An American consumer looking to purchase a high-quality watch will, even in the future, be unable to avoid a Swiss-made watch. This unique asset is of vital importance to our industry.

How much room does a brand have to absorb the increased costs?

In the short term, the room for manoeuvre mainly depends on pre-tariff inventory and brand positioning. In the medium term, if tariffs persist at a high level, a price adjustment or restructuring of cost structures will likely become unavoidable. In many cases, all stakeholders will probably have to absorb part of the increased costs – including, and not least, the American consumer.

Do you think all segments are impacted, or will there be variations depending on positioning?

The high tariff rate fundamentally affects all companies exporting to the United States. In other countries with high tariffs (for example, in Latin America or India – with which Switzerland has negotiated a free trade agreement that will come into effect in October 2025), we’ve observed that such situations can lead to circumvention practices. Consumers purchase watches abroad, a phenomenon we particularly observe in the high-end segment.

The 39% increase follows basic arithmetic (balancing the trade deficit): in your view, what is Donald Trump’s real objective? To pressure the pharmaceutical sector (he has always pushed for lower drug prices in the U.S., where Switzerland is the main exporter)?

The decree behind “Liberation Day” addresses the issue of deindustrialisation in the United States. According to the Trump administration, this has negative consequences for the country’s defence capabilities. This, they argue, provides the legal basis to impose tariffs under emergency powers, i.e., without consulting Congress. This approach is being legally challenged and is currently under judicial review.

Overall, the government’s goal is to repatriate the production of industrial goods to the U.S. to create jobs and reduce dependence on foreign countries, for example, China.

The problem of high drug prices in the U.S. is not new – previous administrations also sought solutions to reduce prices. But part of the issue is domestic, since the large number of American intermediaries also contributes to driving prices up. Pharmaceuticals are, for now, still excluded from the tariffs, but the largest companies have received letters from the U.S. administration threatening them with astronomical tariffs, potentially as high as 250%. The goal is to push them to relocate their production to the United States. Pharmaceutical products represent 48% of Swiss exports to the U.S. and thus contribute significantly to the trade deficit.

Jean-Philippe Bertschy, Managing Director, Head of Swiss Equity Research at Vontobel

Pascal Brand, MONOCHROME – The watchmaking industry is at risk of being heavily impacted. What is your assessment of the potential consequences for the sector?

Jean-Philippe Bertschy – The repercussions could prove devastating for certain watch brands. On top of persistently weak Chinese demand, we’re seeing a sluggish U.S. dollar that dampens tourist spending and a general decline in consumer confidence. Brands with strong pricing power and exceptional desirability will likely manage to limit the damage, as will those still benefiting from long waiting lists. On the other hand, suppliers – some of whom are already seeing order declines of over 30% – are facing drastically reduced flexibility.

How much room does a brand have to absorb the increased costs?

The most immediate tool remains price increases, but after several years of inflation, price elasticity has grown – especially in the entry-level and mid-range segments. As a result, brands will also need to optimise processes and lower costs. Those that manage to bring true product innovation to market will emerge stronger.

Are all segments impacted, or are variations possible depending on positioning?

The entry-level and mid-range segments will be the most exposed. Conversely, in the high-end segment, waiting lists remain long, and the desire to acquire a timepiece meant to last a lifetime remains intact. Consumers with more modest incomes are much more sensitive to price increases.

Is it possible to circumvent U.S. export tariffs by exporting to the U.S. from another market (France, Germany, etc.)?

Goods always tend to find a way, but fully reorganising a supply chain requires time, investment, and deep logistical expertise.

Georges Kern, CEO of Breitling

Pascal Brand, MONOCHROME – The watchmaking industry is at risk of being heavily impacted. What is your assessment of the potential consequences for the sector (downstream: sales; upstream: supply chain)?

Georges Kern – We still don’t know how these tariffs will affect not only the watch industry or Switzerland, but also the global economy. It is therefore too early to assess broader measures. That said, we remain confident that a constructive agreement can be reached between Switzerland and the United States in the coming weeks. I remain optimistic, as several private sector leaders are actively engaged, and I’m convinced that Swiss companies can and will contribute to finding a solution.

How much room does a brand have to absorb the increased costs?

There are three levers we can pull: increasing efficiency, reducing margins – including at the retailer level – or raising prices, not only in the U.S. but globally, in order to offset the additional costs resulting from the imposed tariffs.

Are all segments impacted, or are there variations depending on positioning?

The impact does indeed vary depending on the segment and the brand’s positioning. There are certain price points where increases are more feasible than others. In the entry-level segment, price hikes are more limited. Conversely, in high-end segments – just as in the luxury automotive industry – manufacturers enjoy greater pricing power. We also have some room to adjust our prices, but it remains limited. In all cases, however, a delicate balance must be found between maintaining competitiveness and preserving perceived value for the customer.

10 responses

Although I find the injunction of tariffs outrageous, I have no sympathy for an arrogant and cynical ceo who basically says Americans deserve to pay higher prices and that it’s our fault. Without tariffs, these watch brands thought nothing of raising their already exorbitant prices as much and as often as they could. It would serve them right if the tariffs helped to put people off from buying and put a dent into their bottom line. They’ve gotten away with robbery far too long as it is!

As a resident of free trading nation that despite having a trade deficit with the US is still subject to a tariff Im onboard with your anonymous CEO – the US voted for this, without them this is happening – make them pay.

Under no circumstances is it ok to make people outside the US bear the burden of US taxes.

Flight attendants and others who fly regularly from the US to international destinations as well as tourists will be sporting a lot of expensive new watches on their return trips without boxes.

I guess it won’t be the same for all watchmakers, but Rolex in particular shouldn’t have much trouble with this. They could easily reallocate the watches normally sold in the US to other markets worldwide. After all, there isn’t a single retailer without a waiting list. This might actually be great news for Rolex enthusiasts outside the US—though I suspect that’s wishful thinking. Curious to hear what others think.

As someone who has to pay this 39%, on one hand it is awkward when financial / trade situations, the ongoing currency devaluation, etc change. On the other side, we need to realize no one ‘needs’ a mechanical timepiece. Swiss medical products is a different situation, yet timepieces are a luxury. Perhaps this may slow down demand by the U.S.’ ‘aspirational wealth’ part of their consumption-based economy, the truly wealthy are doing just fine. Someone affluent in Monaco, St. Barts, Singapore, etc. probably won’t notice any difference, we know prices go up. Costs always go up anyway.

How is VAT on your side of the pond?

Greedy Kern has been raking it in by sticking cheap Sellita in ShyteBling and taking Americans for idiots. He can try selling this overpriced garbage elsewhere!

In short, they will rise prices 10% globally to compensate the US tariffs. Wich is kind of unfair for the rest of the world. But also german cars are cheaper in the US than where I live (20 km to the border of Germany, BMW factory maybe 200km, but there is also a big BMW factory here in Austria) also unfair…

“They wanted and elected Trump. Now let American customers pay!” Well I’m an American and here’s my response: I won’t be buying Swiss watches anymore. There’s plenty of great choices from Japan and Germany, among other countries. I’m not a fan of the tariff but it’s going to hurt the Swiss watch manufacturers a lot more than me.

What a snarky comment from Swiss executive. There is another option to higher costs…and that is to not buy Swiss! Time (pun intended) for American brands to rise up again like Elgin or Waltham. I know it will be awhile before I buy a Swiss watch again.

I’m an American and think we absolutely should pay more for the products that our government decides to increase the taxes on. Come on! Why should anyone other than American voters who voted for the administration that wanted it absorb this new tax? I didn’t vote for Trump because he’s unfit for office in ever conceivable way, but my side lost. Unfortunately, I have to pay the taxes that whatever American government is in power implement (even if the legal – let alone intellectual/financial basis for the import taxes Trump is imposing are highly suspect). So the Swiss CEO is correct: we elected this administration, which was very clear during the campaign it wanted to tax imports at a much higher level. We should pay for the taxes (which is what tariffs are) it implements.

Now, it may be in the best interest of Swiss watch brands and their US retailers to eat some of this tax increase through reduced margins in order to maintain sales. But they should only do so in so far as it maintains their bottom line.